BECOMES LARGEST GREENFILED LITHIUM PLAYER IN ONTARIO

PORTFOLIO HIGHLIGHTS

- Beyond Minerals options 57 properties totalling 125,751 hectares and acquires through staking three properties totalling 9,104 hectares, bringing its lithium property portfolio in Ontario to 66 properties covering 147,975 hectares.

- Beyond Minerals now has a significant position in every major LCT pegmatite district known in Ontario.

- Over 500 individual pegmatites known to exist on the properties. Some individual pegmatites are mapped as being over 100 meters wide and traced for up to 2.5 km along strike.

- Significant past drilling information available for several projects:

- Thirty historic drill holes on eight properties intersected pegmatites, with historic drill core logs often describing interesting pegmatite mineralogy, none of which was assayed for rare-elements.

- Historic drill core from three properties is stored in government core library facilities and available for re-examination and resampling.

- On the Stimson Property, possible “spodumene” was noted in the drill core logs within three core intervals, one of which is described as a “granitic complex” over 39.8 meters of core length (from 60.0 m to 99.8 m downhole).

- Several drill holes on other properties are logged as having unidentified blue-green minerals and/or greenish coloured feldspars

Winnipeg, Manitoba, March 31st, 2023 – Beyond Minerals Inc. (the “Company” or “Beyond Minerals”) (CSE:BY) (OTCQB:BYDMF) is pleased to announce that it has entered into agreements to option 57 high potential greenfield lithium properties totalling 125,751 hectares (the “Properties”) and has acquired through staking three properties totalling 9,104 hectares, bringing its lithium property portfolio in Ontario to 66 properties covering 147,975 hectares (the “Transaction”).

“When I was appointed President and CEO of Beyond Minerals earlier this year, I stated that under my leadership, we would accelerate the acquisition and optioning of additional lithium assets and make plans for a robust exploration season in the current calendar year,” said Allan Frame, President and CEO of Beyond Minerals. “I also committed that our acquisition and optioning plan would rest on four pillars: (i) focus on quality assets for which extensive geological data is available, (ii) concentrate on Ontario assets, while being open to strategic transactions in other jurisdictions (iii) maintain financial discipline in all aspects of our business, including acquisition and options terms and conditions and (iv) preserve a share structure that is favorable to value creation for our shareholders.”

“The transaction announced today is consistent with the vision I laid out back in February. Beyond Minerals has now become the largest player in the Ontario’s greenfield lithium exploration with quality lithium assets for which extensive geological data is available, while maintaining financial discipline with regards to the terms and conditions of our acquisitions and options and maintaining a share structure that is favorable to value creation for our shareholders.”

Mr. Frame added: “There are a number of compelling and strategic reasons to focus on Ontario. Ontario is quickly emerging as a reliable global supplier of responsibly sourced critical minerals. World-class deposits of high purity, low-iron spodumene are currently being discovered and advanced toward production in Ontario. We are confident more of these deposits remain to be discovered here. While other jurisdictions such as Quebec have seen success, we feel the economics of transactions being done in Ontario being more compelling and conducive to creating shareholder value.”

Given its extensive portfolio, Beyond Minerals is adopting a project-generator model to maximize exploration dollars, while minimizing dilution. In the coming weeks, the Beyond Minerals will review all the properties to determine which will be advanced by Beyond Minerals’ exploration team and which will be optioned to joint venture partners. Partnering on various projects will provide a source of non-dilutive working capital, partner-funded exploration, and long-term residual exposure to exploration success.

Mr. Frame said: “By adopting the project generator model, our shareholders will be exposed to multiple projects being advanced at once – hence increasing the likelihood of a discovery – with a significant portion of the exploration costs being incurred by our partners.

The agreements announced today were entered into with Bounty Gold Corp. and Last Resort Resources Ltd, both located in Ontario. Jace Angell, President of Last Resort Resources commented: “We collaborated with Gold Bounty Corp to assemble the portfolio of highly prospective greenfield lithium projects being optioned to Beyond Minerals today. Each property in the transaction was staked based on extensive analysis of government recommendations, historical geological reports and boots-on-the-ground reconnaissance work guided by data-driven techniques for the discovery of lithium, cesium, tantalum (“LCT”) pegmatites.”

Jason Leblanc, President of Bounty Gold Corp. commented: “Beyond Minerals’ strategy of focusing on high quality assets for which extensive geological data is available aligned perfectly with our staking methodology. A high threshold of prospective criteria needed to be met before a positive staking decision was made. It took perseverance to dig deep into the geological databases of Ontario, sometimes reading through reports that dated back to the turn of the 20th century, often searching for days without turning up any meaningful leads. But slowly over time, a portfolio of high-quality greenfield lithium properties began to emerge. We conducted preliminary “first pass” prospecting on a number of properties that we staked earlier in 2022, recording the location, photographing and documenting the minerology and characteristics (size/orientation) of pegmatites we found. We discovered several new rare-element pegmatites in the process, validating the staking methodology that we used to assemble our overall portfolio of properties.” Mr. Leblanc concluded: “We believe Beyond Minerals is the right company to now advance these projects forward and deliver further exploration success.”

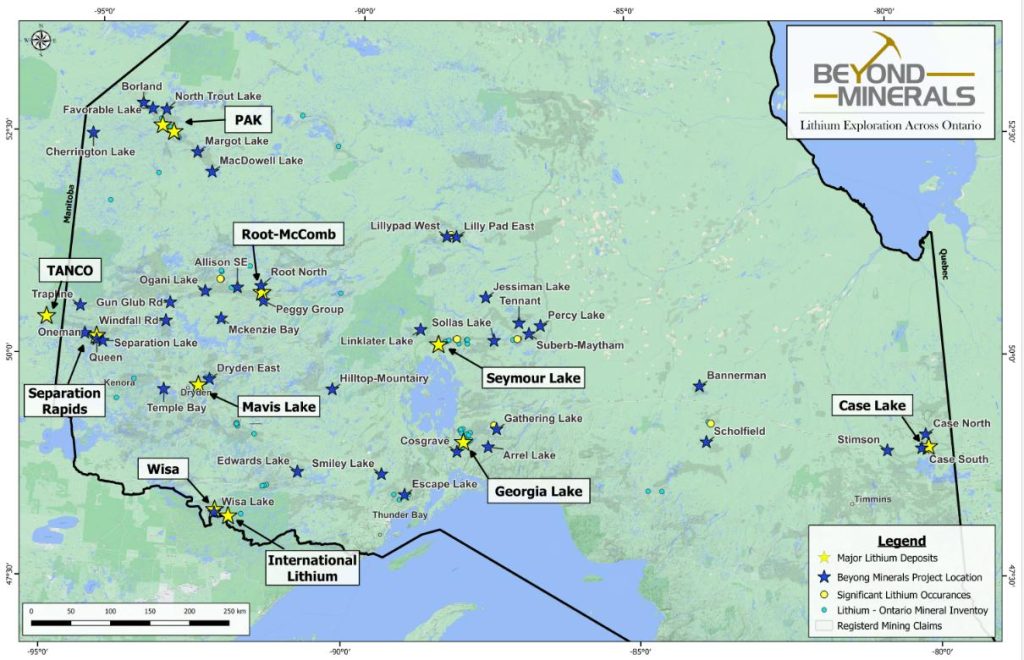

Figure 1 – Location of projects across Ontario

Summary of prime exploration areas for 2023

The following highlights several projects on which Beyond Minerals expects to focus its exploration during the 2023 exploration season.

- Frontier Lithium District

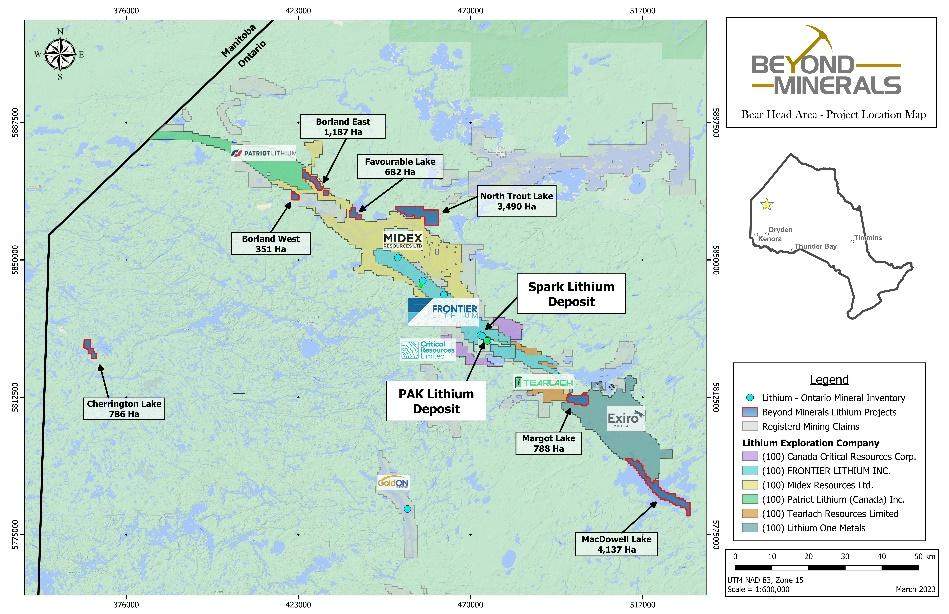

Figure 2 – Tenure map of the Frontier Lithium district

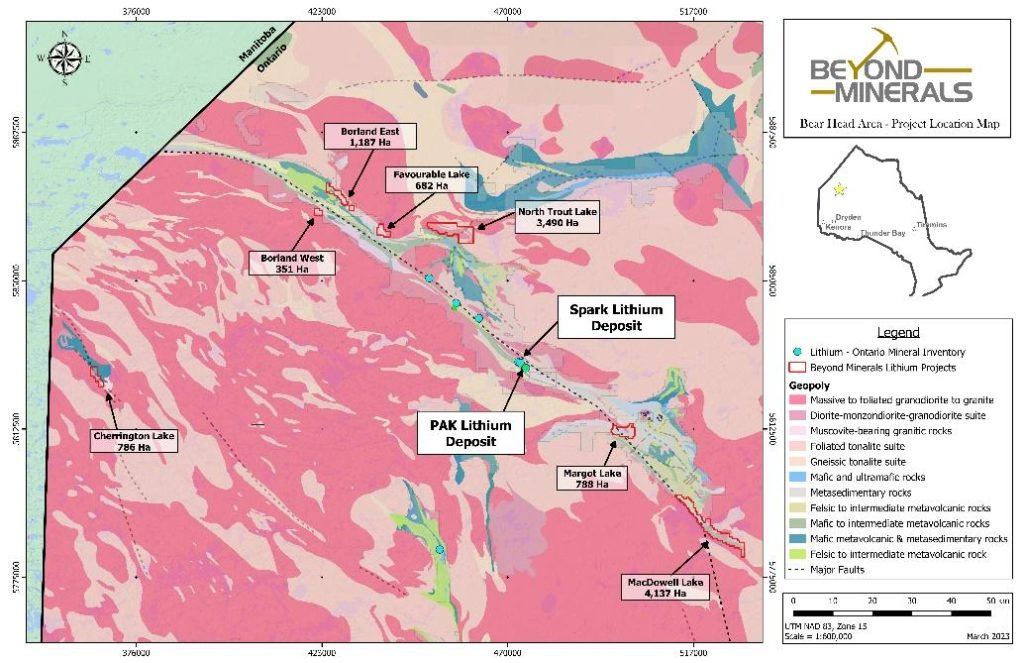

Figure 3 – Geological map of the Frontier Lithium district

Highlights of the MacDowell (4,137 hectares) and Margot Lake (1,393 hectares) properties in the Frontier Lithium district

These properties are located 27-50 km southeast of Frontier Lithium’s (TSXV: FL) Pak/Spark LCT pegmatites. A historic government report from 1939 describes pegmatites up to 200 ft in width, some of which contain biotite, muscovite, pyroxene, tourmaline and garnet. Spodumene is a type of pyroxene mineral. The geological setting, S-type peraluminous granite and their associated pegmatites between and within metasediments (to the north) and metavolcanics (to the south) along the Bear Head Fault Zone is analogous to the geological setting at Frontier Lithium’s LCT pegmatites.

- Georgia lake district

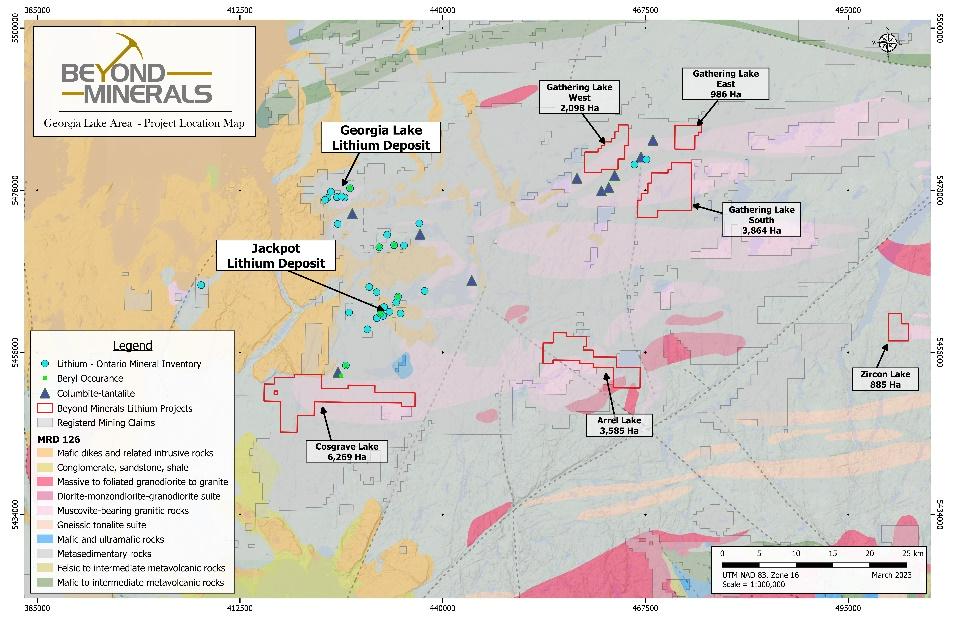

Figure 4 – Tenure map of the Georgia Lake district

Figure 5– Geological map of the Georgia District

Highlights of the Cosgrave (6,269 hectares) and Gathering Lake (6,948 hectares) properties in the Georgia Lake district

These properties collectively provide 13,217 hectares of high potential property in the prolific Georgia Lake-Gathering Lake LCT pegmatite field. Each property is within 3 km of known spodumene-bearing pegmatites. OGS samples collected within 700 meters of the Gathering Lake Property during a reconnaissance survey of this LCT pegmatite district in 2006 yielded significantly elevated lithium content in muscovite samples (1702 ppm Li and 2203 ppm Li in samples 03-FWB-80-02 and 03-FWB-81-02, respectively) and sample 03-FWB-82-01, a potassium feldspar sample collected on property, was one of the most evolved potassium feldspar samples in the district, having 115 ppm Cs, 2687 ppm Rb and K/Rb of 37.

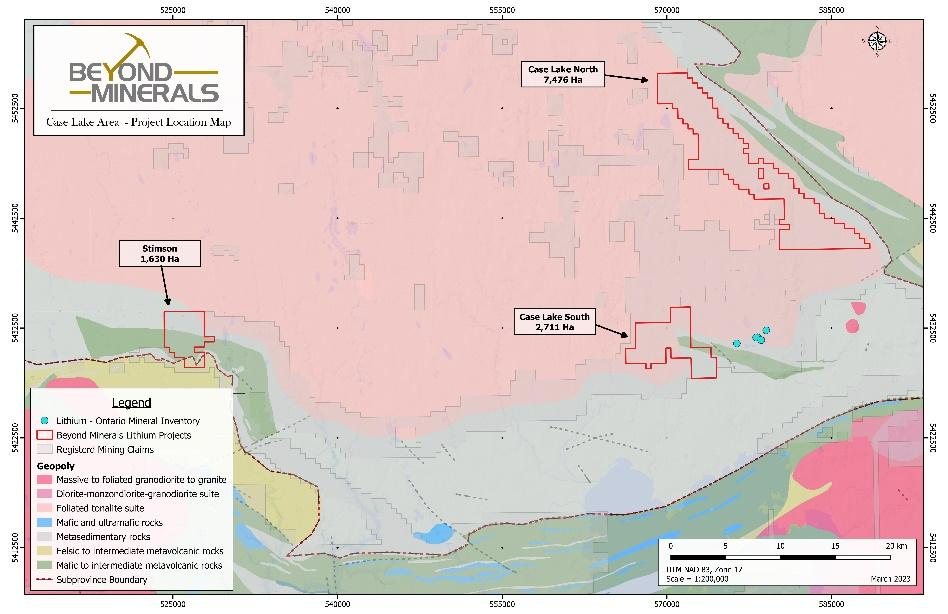

- Case Lake District

Figure 6 – Tenure map of the Case Lake district

Figure 7 – Geological map of the Case Lake district

Highlights of the Case Lake North (7,476 hectares) and Case Lake South (2,711 hectares) properties in the Case Lake district

These properties collectively covering 10,187 hectares of Case Lake Batholith contact zone in a similar geological setting as the neighbouring Power Metals’ (TSXV: PWM) LCT pegmatite swarm. Four potential dome structures (laccoliths) are covered by the Case Lake North property, one of which is shown on government maps as having mapped pegmatites in every outcrop exposure. Along with the Stimson Property, many target areas recommended by the OGS for rare-element pegmatites in 2021-2022 are covered by Beyond Minerals’ new properties.

Figure 8 – Geological map of the Stimson property in the Case Lake district

Highlights of the Stimson (1,630 hectares) property in the Case Lake district

This property is located along the south contact of the Case Batholith, 50 km west of Power Metals (TSXV: PWM) LCT pegmatites associated with the same intrusive body, within an area recommended for lithium exploration by the Ontario Geological Survey (OGS) in 2021-2022. Historic drill core logs of diamond drill holes collared by Noranda in 1994 indicates possible spodumene may have been encountered within a “granitic complex” that was intersected between 60.0 – 99.8 meters downhole (39.8 meters core interval).

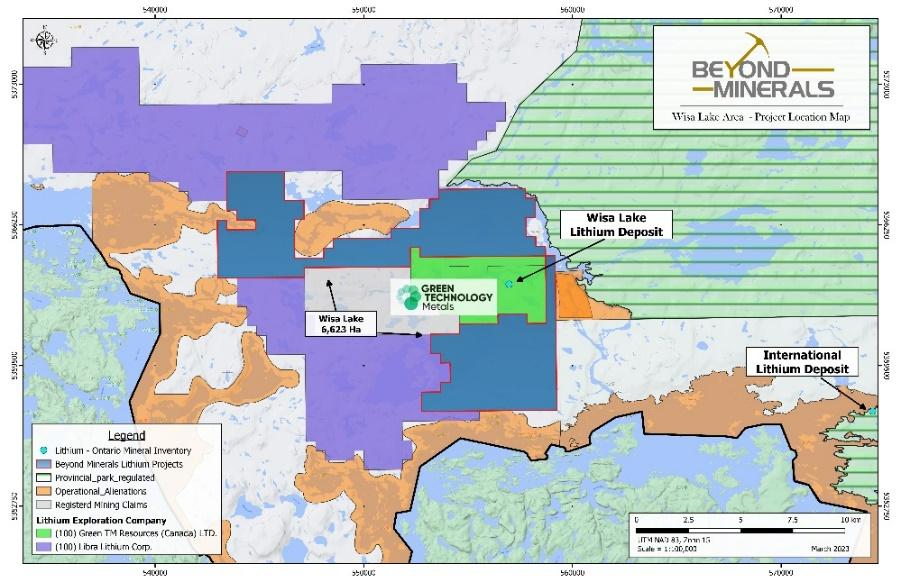

- Wisa Lake District

Figure 9 – Tenure map of the Wisa Lake district

Figure 10 – Geological map of the Wisa Lake district

Highlights of the Wisa Lake (6,549 hectares) property

This property covers a large area surrounding Green Technology Metals’ (ASX: GT1) project, with spodumene-bearing pegmatite (GT1’s “South Zone”) which has yielded grab samples up to 6.38% Li2O, being only 700 meters north of the property boundary. OGS reconnaissance sampling shows pegmatites across the area are fractioned/evolved and recommended additional exploration for LCT pegmatites.

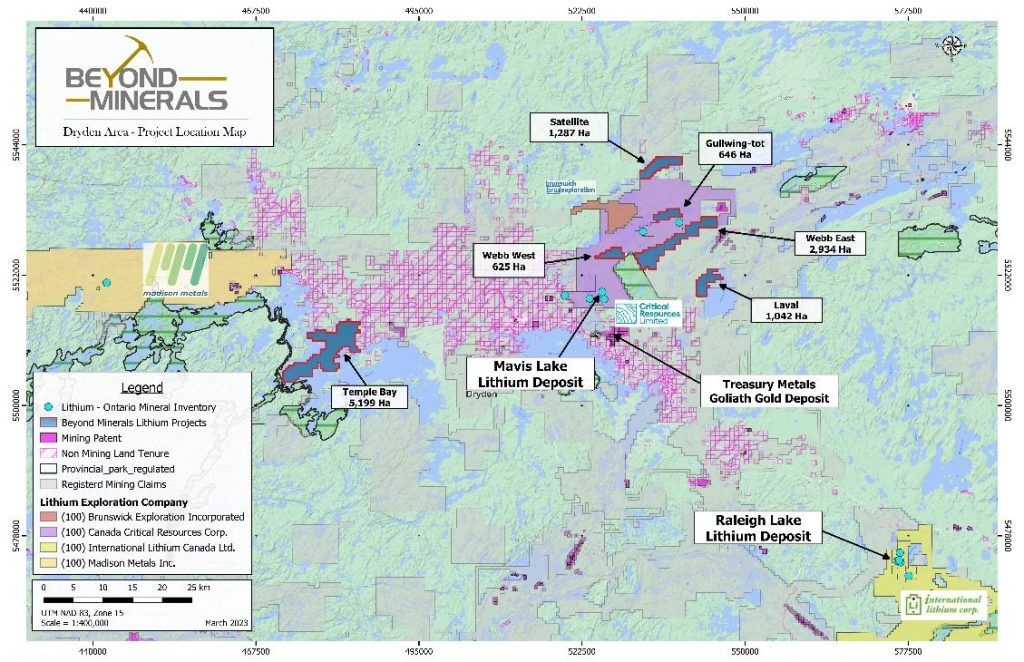

- Dryden Mavis Lake District

Figure 11 – Tenure map of the Dryden Lake district

Highlights of the Temple Bay (5,111 hectares) property in the Dryden district

This property is located 40 km west of Critical Resources’ (ASX: CRR) flagship Mavis Lake project. At Temple Bay, over 50 individual pegmatites have been mapped, with the largest currently known being up to 75 meters wide and at least 600 meters long. The pegmatites were discovered by prospector F. Plomp in 1997, when grab samples collected yielded up to 182 ppm Ta. The OGS examined the area during their reconnaissance survey of peraluminous granites and rare element pegmatites and recommended additional exploration along strike of the tantalum bearing pegmatites to determine whether they transition into lithium rich pegmatites.

Figure 12 – Geological map of the Dryden Lake district

Highlights of the Laval (1,042 hectares) property in the Dryden district

The Laval property is located only 15 km east of Critical Resources’(ASX: CRR) flagship Mavis Lake project. At the Laval property, a white pegmatite measuring up to 100 meters wide has been traced along strike for 2.5 km. This pegmatite was examined during an industrial minerals project in the 1990’s, when the pegmatite was examined for its suitability to produce mica and feldspar. A mica sample was assayed for lithium and produced a result of 1420 ppm Li (0.305% Li2O). In a government geological report of Laval-Hartman Township written around the same time, the author concluded these pegmatites “represent the extension of the Dryden lithium-bearing pegmatite field into the map area”

- Eastern English River District

Figure 13 – Tenure map of the Eastern English River district

Figure 14 – Geological map of the Eastern English River district

Highlights of the Sollas Lake (6,522 hectares) property in the Eastern English River district

The Sollas Lake property is located along the English River-Wabigoon Subprovince boundary 16 km along strike to the east of Green Technology Metals (ASX: GT1) newly acquired Junior Lake Property. Historic diamond drilling on the property for other commodities completed by Mingold Resources in 1989 intersected pegmatites in all three drill holes collared on the property, with the longest intercept being over 95.5 ft of core length. The pegmatites are described as having interesting minerology, including muscovite, green mica, greenish coloured feldspar, megacrysts, garnets and unidentified green minerals. None of the core was assayed for rare elements. Drill core from one of these historic drill holes is stored in government drill core libraries and is available for re-examination and sampling.

Highlights of the Tennant Lake (3,544 hectares) property in the Eastern English River district

This property has three historic drill holes collared by Jilbey Exploration in 1994 while exploring for other commodities. All three holes intersected pegmatite, the longest over 32.33 meters of core length. This pegmatite is also described in the drill logs as having interesting minerology, including heterogenous texture, muscovite, unidentified black mineral, white mica, garnets, and unidentified blue-green mineral. These drill holes were specifically referenced within the OGS’ 2022-2023 Recommendations for Exploration which highlighted the rare element potential of Eastern English River Subprovince and recommended additional exploration.

Highlights of the Maytham (7,400 hectares) and Superb North (2,054 hectares) in the Eastern English River districts

These properties are within an area studied by the OGS and where they described the pegmatites that were observed as having similarities to known fertile granites and their associated pegmatites at South Aubrey and the Allison Lake Batholith (both of which are being explored by Green Technology Metals). The OGS established a fractionation trend in a westward direction on the peraluminous Maytham-Queenston Batholith (toward Beyond Minerals property). The properties cover almost 20 km of English River-Wabigoon Subprovince boundary which hosts numerous LCT pegmatite groups over a 120 km length between Linklater Lake and Superb Lake. The nearest know spodumene-bearing pegmatite at Superb Lake is only 3 km south of the Superb North Property.

- Mountainry & Hilltop District

Figure 15 – Geological map of the Mountainry & Hilltop district

Highlights of the Mountairy (7,503 hectares) and Hilltop (4,203 hectares) properties

These properties cover 133 mapped pegmatites that are described by government geological reports as being up to “several hundred feet in width and up to 1,000 to 1,500 feet in length”. The author states that the pegmatites did not receive close examination and may warrant further attention. As these pegmatites are located along the Wabigoon-Winnipeg River Subprovince boundary and are reported to be heterogenous and contain accessory minerals (garnets, muscovite) suggesting a peraluminous source, they may have good potential for rare-element mineralization.

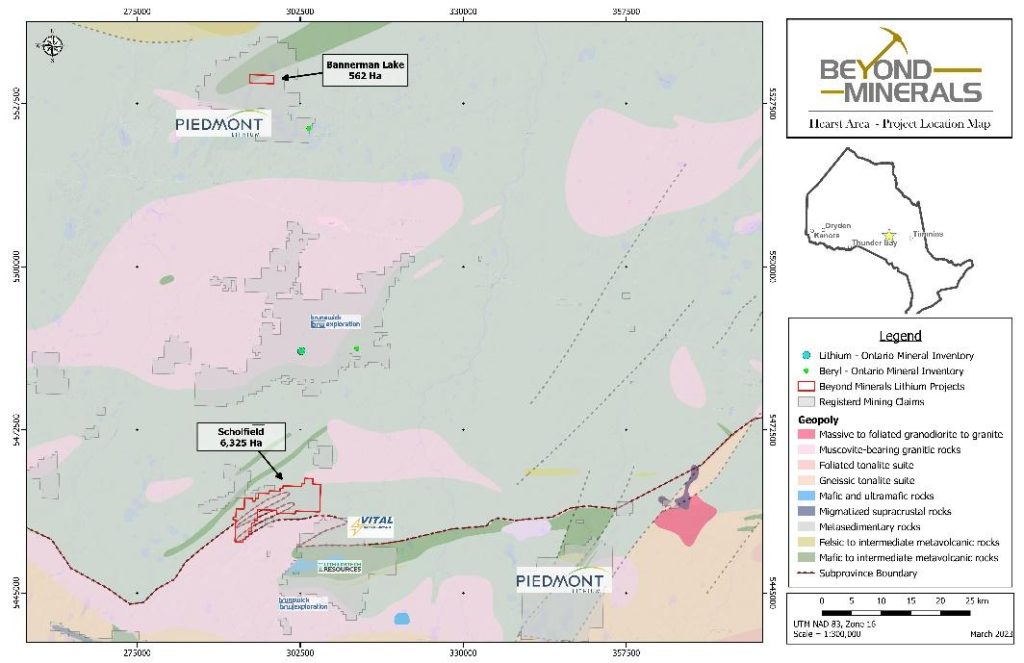

- Hearst District

Figure 16 – Tenure map of the Hearst District

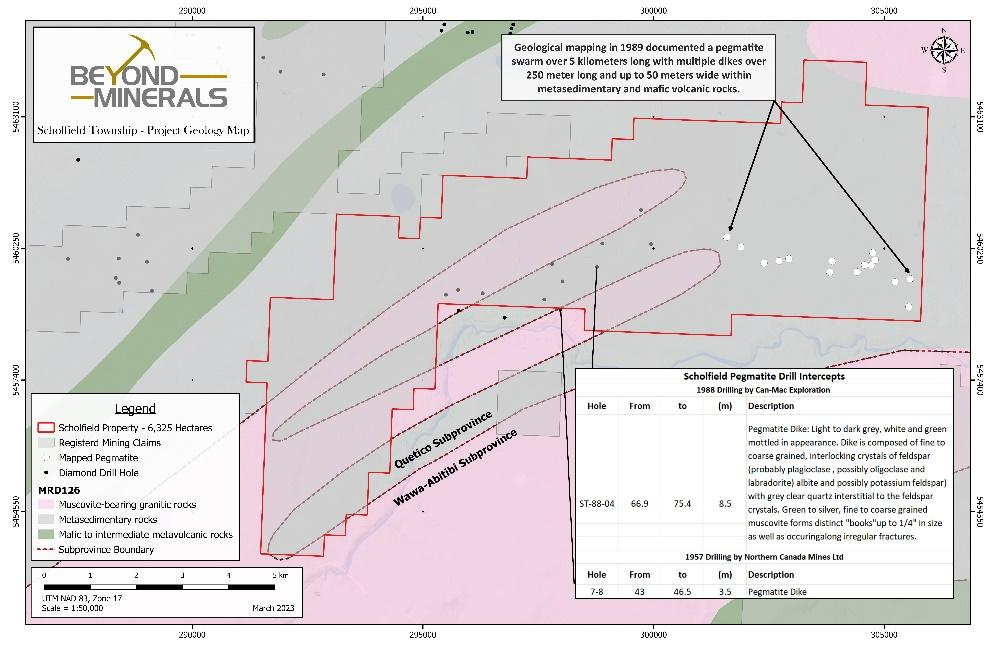

Figure 17 – Geological map of the Scholfield property

Highlights of the Scholfield (6,346 hectares) property in the Hearst district

This property covers over 15 km of Quetico-Wawa-Abitibi Subprovince boundary 23 km south of Brunswick Exploration’s (TSXV: BRW) Hearst Property which is anticipated to be the subject of their upcoming 2023 drill programs. Historical assessment work by Kaphearst Resource Corp in 1986 document numerous pegmatites up to 25 meters wide and over 200 meters in length exposed in surface outcrops. Historic diamond drilling for other commodities completed by Can-Mac Exploration in 1988 intersected pegmatite over 28.0 ft of core length with interesting minerology, including interlocking crystals of feldspar-quartz (intergrowth), silver and green “books” of muscovite, and a white-green mottled appearance.

The Transaction was completed pursuant to the terms and conditions of a series of multi-property option agreements (the “Option Agreements”) entered into by the Company, as optionee, with each of Bounty Gold Corp. and Last Resort Resources Ltd., as optionors. Pursuant to the Option Agreements, the Company will make cash payments to the optionors totaling up to $3,350,000 and issue to the optionors an aggregate of up to 11,325,000 common shares in the capital of the Company (the “Shares”) as follows:

- within 5 business days of the date of the Option Agreements, by paying $420,000 and issuing 1,880,000 Shares;

- on or before the first anniversary of the date of the Option Agreements, by paying $590,000 and issuing 2,490,000 Shares;

- on or before the second anniversary of the date of the Option Agreements, by paying $1,080,000 and issuing 3,210,000 Shares; and

- on or before the third anniversary of the date of the Option Agreements, by paying $1,260,000 and issuing 3,745,000 Shares.

Upon acquiring a 100% interest in any of the Properties, the Company shall grant the optionors a 2.0% net smelter return royalty on such Properties, one-half of each of which may be repurchased by the Company for $1,200,000 to reduce such royalty to a 1.0% net smelter return royalty. In addition, the Company shall pay the Optionors a $1-million milestone payment, payable in cash or shares at the option of the Company, for each initial mineral resource estimate filed by the Company in respect of a deposit comprising part of the Properties that discloses a deposit or orebody exceeding 5,000,000 metric tonnes with an average grade equal to 1.0% Li2O or greater.

The Company has the right to assign or terminate the option in respect of any of the Properties to reduce the cash payments and Shares payable by the Company to the optionors under the Option Agreements.

Qualified Person and Third-Party Data

The scientific and technical information in this news release has been reviewed and approved by Craig Gibson, Ph.D., P.Geo., a director of the Company (the “Qualified Person”). Dr. Gibson is a “qualified person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Certain information in this news release regarding the presence of mineral deposits and the size of such deposits is based on information that has been obtained from publicly available information and industry reports, which constitute historical estimates. Such reports generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed. While the Company considers historical estimates to be relevant to investors, as they may indicate the presence of mineralization, the Qualified Person has not done sufficient work for the Company to classify the historical estimates as current “mineral resources” or “mineral reserves” (as defined in NI 43-101). The potential quantities and grades of exploration targets and nearby properties referenced in this news release are conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in any of the targets being delineated as a mineral resource. The Company has not independently verified and cannot guarantee the accuracy or completeness of the historical estimates and other third-party data contained in this news release and investors should use caution in placing reliance on such information.

About Beyond Minerals Inc.

Beyond Minerals Inc. is engaged in the business of mineral exploration and the acquisition of mineral property assets in Canada. Its objective is to locate and develop critical mineral properties, including lithium assets, and other economic precious and base metal properties of merit, starting with the exploration of its Fabie-Easterchester project in the province of Quebec and its Peggy Group Lithium project and other properties in the North Trout Lake, Borland Lake, Favourable Lake, and Gorman River areas of Northwestern Ontario.

For more information, please refer to the Company’s website at www.beyondlithium.ca

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking information” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, anticipated content, commencement, and cost of exploration programs in respect of the Company’s projects and mineral properties, anticipated exploration program results from exploration activities, resources and/or reserves on the Company’s projects and mineral properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking information. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward-looking information can be identified by words such as “pro forma”, “plans”, “expects”, “will”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In stating the forward-looking information in this news release, the Company has applied several material assumptions, including without limitation, that market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration of the Company’s properties, the availability of financing on suitable terms, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the statements of forward-looking information. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, the proposed expenditures for exploration work on its properties, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, changes in laws, regulations and policies affecting mining operations, risks relating to epidemics or pandemics such as COVID-19, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated February 23, 2022 and other filings of the Company with the Canadian securities regulatory authorities, copies of which can be found under the Company’s profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward-looking information. The Company undertakes no obligation to update any of the forward-looking information in this news release except as otherwise required by law.

For further information, please contact:

Alan Frame

President and CEO

Tel: 403-470-8450

Email: allan.frame@beyondlithium.ca

Jason Frame

Manager of Communications

Tel: 587-225-2599

Email: jason.frame@beyondlithium.ca